Charge Id – What is the problem?

This is the start of a series of blog posts where I try to build an online personal budgeting system.

The motivation for this was me trying to do a household budget using existing tools (Pocketbook, CashDesk, QuickBooks, Xero).

Each time I needed to classify a large number of transactions manually (except Pocketbook they have got a pretty good classification engine)

As I do lots of transfer between accounts the summaries never made sense. So I thought Id give it a go to build my own personal finance budgeter.

Goals

- Discover the Who, What When, Where, Why and How a money transaction occurred purely from the metadata

- Website that allows users to connect/upload their bank accounts

- Connect to a users bank account using bankstatements.com.au / basiq.io (hoping to switch to Open Banking OAuth when available)

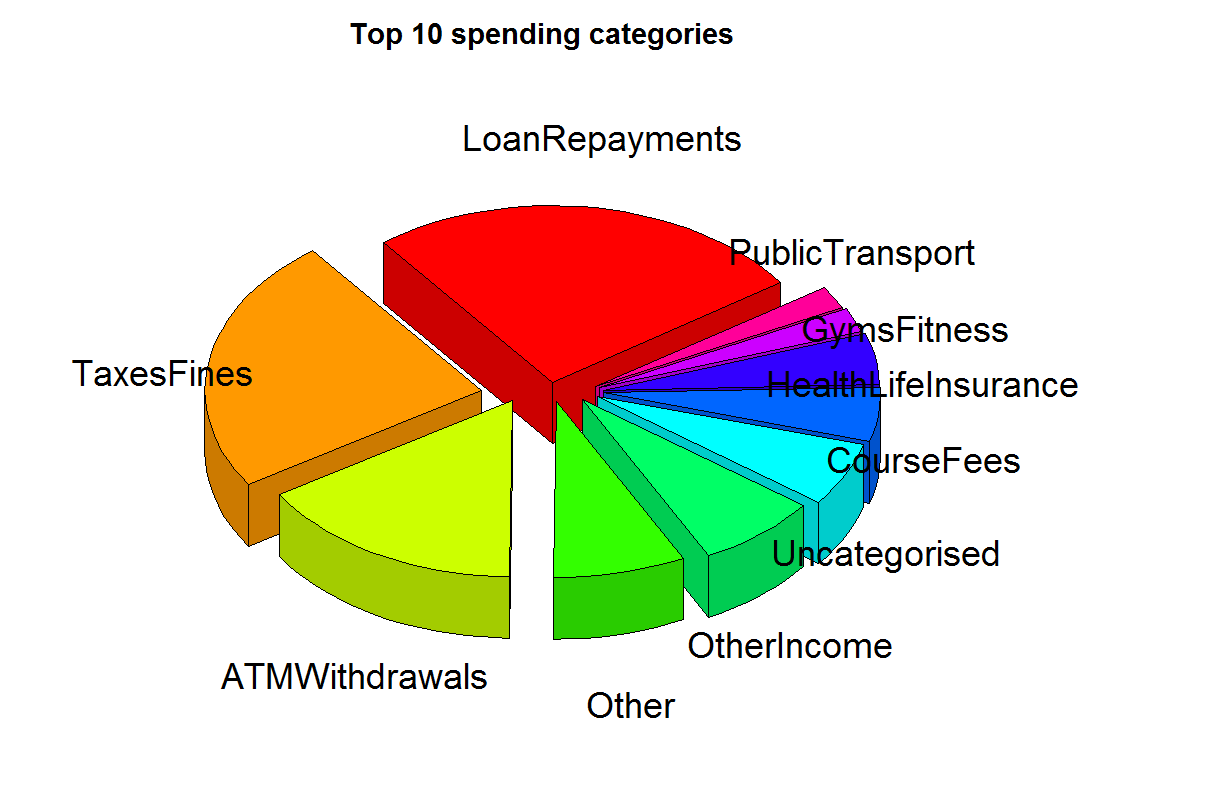

- Classify bank statements into categories & sub categories

- Summarise personal finances and display to a consumable way

- Predict spend over time & necessary budgeting

- Find savings / tax deductions (mortgage, insurance etc)

The code for this solution is hosted on GitHub

https://github.com/chrismckelt/vita

Posts in this series

Charge Id – scratching the tech itch

Charge Id – lean canvas

Charge Id – solution overview

Charge Id – analysing the data

Charge Id – the prediction model

Charge Id – deploying a ML.Net Model to Azure

Code

https://github.com/chrismckelt/vita

Published: